Tennessee's Best Port

Explore

We serve as Tennessee's premier location for facilitating marine cargoes. With qualified teams and connections for land and maritime domains, we're proud to be apart of keeping the trading industry alive in our nation. It's our goal to support economic growth for our region by enabling local and foreign transports.

administrator@portofcateslandingtn.gov | (731) 253-3338

The Highlights

Of our port

Brand new facility

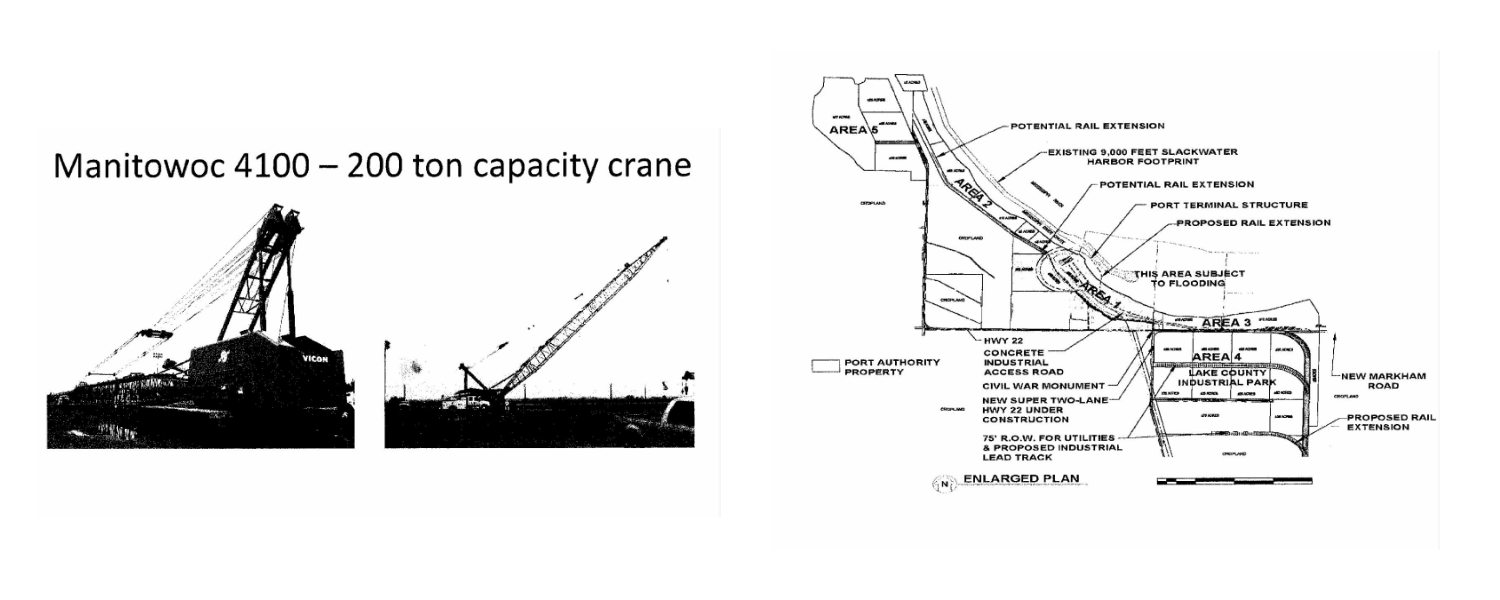

Barge dock in 9,000 ft. slack water harbor

Mile 900 Lower MS. River. right ascending bank

53 miles south of Cairo, IL, 175 miles north of Memphis, TN by water

Barge dock holds 6 barges at a time

Barge fleeting area for 25+ barges in slack water

You can do your own loading and unloading or the POCL will do it for you

Port is authorized Free Trade Zone #283

37,500 sq. ft. warehouse with 5-20 ft doors

Above 100 year flood plane

10 ft. high cement exterior walls

High Ceiling (24 ft eves 30 ft center - 1 brace in center of building

Floor load bearing 2,000 lbs - concrete 8 in thick reinforced with #4 bar on 12 in centers

Truck Scale with radiation detection

400ft x 300ft, 12 and 18 inch thick rock-hard pack lay down adjacent to the dock

Additional 1,200 ft x 150 ft hard pack lay down area

Well lit for night work at the dock and the lay down areas

Office staffed 5 days per week

Foreign Trade

Learn More

Foreign Trade Zone No. 283 (FTZ 283) is prepared to assist businesses regardless of size and whether engaged in importing or exporting. However, many companies are unaware of the sizeable cost savings and other benefits offered by taking advantage of an FTZ program. Utilizing an FTZ can significantly reduce costs from customs duties, taxes and tariffs; improve global market competitiveness; and minimize bureaucratic regulations. Outside the United States, there are many other names for FTZs, including free, foreign, or export processing zones. Below are some benefits of using an FTZ as published at this website: https://foreign-trade-zone.com/benefits.htm.

All the benefits the Foreign-Trade Zones program can offer manufacturers and processors

located in the United States are too numerous to list here. But, there a few main benefits that

account for most of the companies that use the Zones program. Those benefits are listed below:

Relief from inverted tariffs—In certain instances, there are tariff (import duty) relationships that actually penalize companies for making their product in the United States. This occurs when a component item or raw material carries a higher duty rate than the finished product. Hence, the importer of the finished product pays a lower duty rate than a manufacturer of the same product in the United States. This gives the importer an unfair and unintended advantage over the domestic manufacturer. The Foreign-Trade Zones program levels the playing field in these circumstances.

FOR EXAMPLE: A Foreign-Trade Zone user imports a motor (which carries a 4% duty rate) and uses it in the manufacture of a vacuum cleaner (which is free of duty). When the vacuum cleaner leaves the FTZ and enters the commerce of the U.S., the duty rate on the motor drops from the 4% motor rate to the free vacuum cleaner rate. By participating in the Zones program, the vacuum cleaner manufacturer has virtually eliminated duty on this component, and therefore reduced the component cost by 4%.

Duty exemption on re-exports—Without a zone, if a manufacturer or processor imports a component or raw material into the United States, it is required to pay the import tax (duty) at the time the component or raw material enters the country. However, a Foreign- Trade Zone is considered to be outside the commerce of the United States and the U.S. Customs territory. So, when foreign merchandise is brought into a Foreign-Trade Zone, no Customs duty is owed until the merchandise leaves the zone and enters the commerce of the United States. Only then is the merchandise considered imported and the duty paid. If the imported merchandise is exported back out of the country, no Customs duty is ever due.

Duty elimination on waste, scrap, and yield loss—Again, without a zone, an importer pays the Customs duty owed as material is brought into the United States. This is because the material is considered imported at this point. If the processor or manufacturer is conducting its operations within a zone environment, the merchandise is not considered imported, and therefore no duty is owed until it leaves the zone for shipment into the United States. To demonstrate how this would benefit a company that has scrap, waste, or yield loss from an imported component, lets look at a chemical processing plant.

FOR EXAMPLE: A chemical plant manufacturing hydroxywidgitpropolyne, which carries a 15% duty rate, uses the raw material oxyovertaxophene, which also carries a 15% duty rate, for one of its raw materials. Part of the production process consists of bringing the imported oxyovertaxophene to extreme temperatures. During this process 30% of the oxyovertaxophene is lost as heat. If a processing company not in the Zones program imports $10,000,000 per year of oxyovertaxophene, it will pay $1,500,000 in duty as the raw material enters the United States.

If the same company utilizes the zones program, it does not pay duty on the oxyovertaxophene until it leaves the zone and is imported into the United States. The zone user brings the oxyovertaxophene into the zone with no duty owed. It then processes the oxyovertaxophene into hydroxywidgitpropolyne. Remember, during this process 30% of the raw material is lost due to waste factors, so the $10,000,000 in oxyovertaxophene is now worth only $7,000,000. Assuming all of the end product is sold into the United States, the 15% Customs duty totals only $1,050,000. This represents a savings of $450,000.

While at first glance it might look like the Zones program is simply benefiting an importer, it is important to remember that its competitors making the same product overseas already have the benefit of not having to pay on the yield loss in the production of their hydroxywidgitpropolyne.

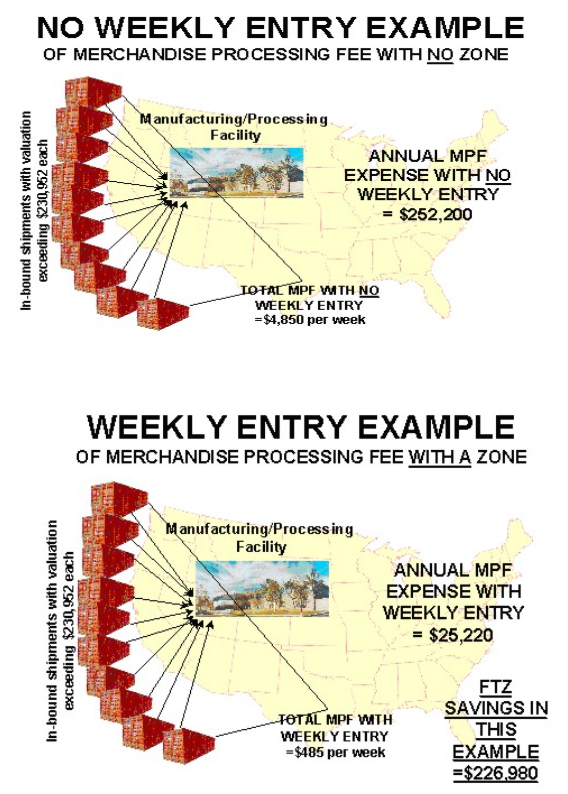

Weekly Entry Savings—On May 18, 2000 the Trade and Development Act of 2000 was passed and signed by President Clinton. This Act had a provision in it that allowed the use of the Weekly Entry procedure for all manufacturing and distribution Foreign-Trade Zones.

Weekly Entry (allowed only to Foreign-Trade Zone users) provides economies for both Customs and Foreign-Trade Zone users. Under Weekly Entry procedures, the zone user files only one Customs Entry per week, rather than filing one Customs Entry per shipment. Customs no longer has to process an entry for each and every shipment being imported into the zone, and the Foreign-Trade Zone community no longer has to pay for the processing of each and every entry.

Companies located outside Foreign-Trade Zones pay a .21% merchandise processing for each and every formal entry processed by U.S. Customs. There is a minimum $25 processing and a maximum $485 processing fee per Entry, regardless of the duty rate on the imported merchandise. The maximum processing fee is reached for Entries (shipments) with a value over $230,952. Companies often receive many shipments over this amount.

FOR EXAMPLE: 10 shipments per week, each with a value of over $230,952, would amount to a merchandise processing fee of $4,850 ($485 x 10) per week. If this number is annualized the amount is $252,200 (52 x $4,850) per year.

Companies in a Foreign-Trade Zone may take advantage of the Weekly Entry procedure.

In the case of the above example, Weekly Entry would provide for one Entry per week.

For example: the 10 ($230,952) shipments per week would be filed as a single shipment

of $2,309,520 each week. The merchandise processing fee would amount to the

maximum of $485 total for the week. If this fee is annualized utilizing Weekly Entry it is

a total of only $25,220 yearly. In this example Weekly Entry provides a savings of

$226,980 per year. Each company’s savings could be significantly more or less

depending on the number of shipments received during the year. A graphic example of

Weekly Entry savings is shown below.

Duty Deferral—Again, since Foreign-Trade Zones are outside the Customs territory of

the United States, goods are not imported until they leave the zone. Therefore, Customs

duty is deferred until merchandise is imported from a Foreign-Trade Zone into the United

States. So, instead of companies having substantial monies tied up in Customs duties on

their inventory, they have use of that money for other purposes.

There are many other substantial benefits that the Zones program has to offer manufacturers and distributors in the United States, but the benefits listed are the key benefits that attract most companies to the Zones program. More and more companies look globally when deciding to locate or expand a new manufacturing or processing facility. When these companies make these location and expansion decisions, they do take into account all costs of manufacturing in a certain country. Unfortunately, there are unintended import tax penalties for many companies located in, or considering locating in, the United States. The Foreign-Trade Zones program plays an important role in providing a level playing field when investment and production decisions are made. While the U.S. government might incur a reduction in Customs duty revenue by the use of the Zones program, it more than makes up for it by the income tax it gains from the jobs created or retained. In addition, local governments benefit from sales and property taxes.

The Foreign-Trade Zones program has proven to be a successful trade program by consistently creating and retaining jobs and capital investment in the United States.

Contact Details

& LOCATIONS

For information concerning becoming a member of Foreign Trade Zone No. 283, or if you need assistance, please contact: Sylvia Mathis Palmer

Northwest Tennessee Regional Port Authority

422 McGaughey, P.O. Box 1729

Dyersburg, TN 38024

administrator@portofcateslandingtn.gov | (731) 253-3338

Currently, Foreign Trade Zone 283, which is administered by the Northwest Tennessee Regional Port Authority, has four (4) operating clients:

MAT Industries, Jackson, TN

MTD Products, Martin, TN

R&S Solutions, Jackson, TN

TBC Corporation, Rossville, TN